KiwiSaver is a great way to save for retirement. Simply select your investment fund, keep up your contributions and leave our experts to do the rest. Easy.

But how do you know which is the right fund for you?

Do you choose a more aggressive strategy that may bring higher returns? Or invest in a conservative fund to try and protect your money? Or can you find the best of both?

The right investment strategy for you depends on a few things, but one of the biggest factors is the time you have until you need to access your money. What’s the right strategy for where you’re at in life?

Set the right strategy at the right time

Most investments go up and down. Some can be bumpier in the short term, but potentially more rewarding over time. Others can be less risky on a shorter timeframe, but potentially not as effective for long term investing.

So, the secret of smart investing is managing your risk over time. But who’s got the time to check-in every year and reset the settings on your investment?

Don’t worry, you can leave it to us. GlidePath is a simple hassle-free option for your KiwiSaver account, with annual tweaks to your mix of funds, based on your age.

It’s like autopilot for your KiwiSaver account

GlidePath works by adjusting your investment fund mix based on our recommendation for someone your age.

When you’re younger, you have more time to ride out the ups and downs of the market. So as long as you’re not planning to use your KiwiSaver money in the short term to help purchase your first home, it can be a good time to invest in higher return growth funds.

Then, as you get closer to retirement, and accessing your KiwiSaver money, you may want to reduce your risk and invest more in balanced and conservative funds. So every year after your birthday, we’ll adjust the settings to get the right mix for your different stages of life*.

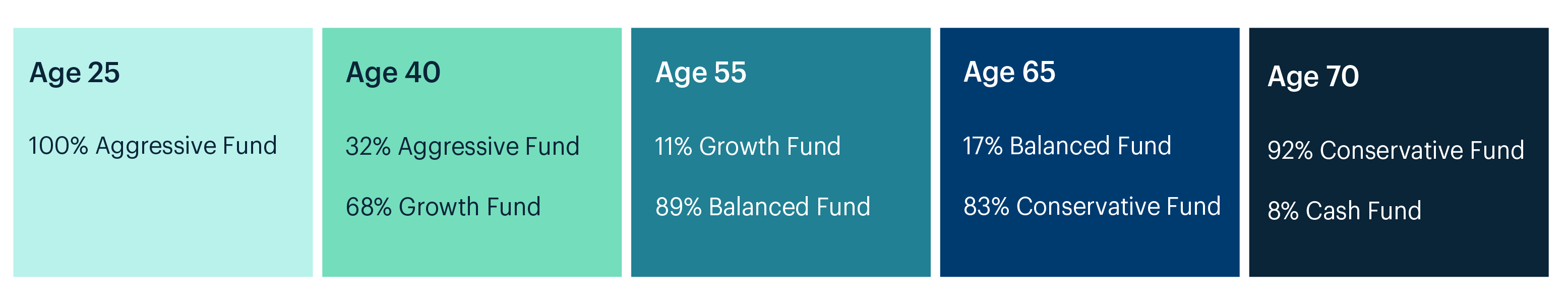

This diagram shows how we’ll start with more high growth investments while you’re younger and gradually reduce the risk through to retirement and beyond*.

Is GlidePath right for you?

GlidePath is great for anyone who’s committed to saving for retirement but doesn’t want to get involved in the day to day*. It doesn’t cost any extra and helps to:

Keep things simple – it’s a simple, hassle-free way to save.

Keep you on track for your retirement – you’ll always have the right mix of funds for your lifestage.

Reduce stress – relax and leave the rest up to us.

And if you decide you want a more hands-on approach in the future, you can opt-out of GlidePath at any time.

You can switch to GlidePath in Fisher Funds Online or the mobile app. Or if you’d like to have a chat about whether it’s right for you, just give us a call on 0508 347 437. Our friendly team can talk you through it, so you can relax knowing your KiwiSaver account is in expert hands.

*Notes:

The GlidePath model is based on assumptions regarding retirement age, life expectancy and expected returns for each asset class. If any of these factors change significantly, we will amend our model. This could result in a one-off change to your asset allocation to bring it into line with our new model.

The diagram shows how GlidePath works for Fisher Funds KiwiSaver Plan at various ages. You can find more information about GlidePath for Fisher Funds KiwiSaver Plan, including the Terms & Conditions in the PDS and the Other Material Information document.

For information on GlidePath for Fisher Funds KiwiSaver Scheme click here. For information on GlidePath for Fisher Funds TWO KiwiSaver Scheme click here.

GlidePath does not take into account all your personal circumstances and may not be suitable for you, as it’s based on saving for retirement. For example, it may not be suitable if you plan to use your KiwiSaver money for your first home. GlidePath also does not take into account your personal risk tolerance and may not be suitable if you’re particularly cautious when it comes to investing.